Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Here's the harsh truth: 90% of prop traders blow their accounts within the first 3 months. 💥

But the 10% who make it to $100K+ all follow the same proven framework. They didn't get lucky: they mastered risk management while everyone else chased quick wins.

You'll discover the exact system professional crypto traders use to compound their accounts from $10K to $100K+ without blowing up. This isn't theory: it's the battle-tested framework that separates consistently profitable traders from the wreckage of failed accounts.

The traders scaling to six figures all use this identical system:

✅ Position Sizing Mastery – Never risk more than you can afford to lose

✅ Dynamic Stop-Loss Strategy – Cut losers fast, let winners run

✅ Portfolio Diversification – Spread risk across multiple crypto assets

✅ Leverage Control – Use futures leverage as a tool, not a weapon

Each pillar works together to create compound growth instead of boom-bust cycles that destroy accounts.

Professional crypto prop traders never risk more than 1-2% per trade. Period.

Here's why this seemingly "boring" approach creates millionaires:

The beauty? As your account grows, your absolute dollar profits grow exponentially while your risk percentage stays constant.

The Dynamic Sizing Rule: ⚡️

Most failed traders do the opposite: they increase size when losing (trying to "get even") and decrease size when winning (fear of giving back gains). Don't be most traders.

Your stop-loss strategy determines if you'll join the $100K club or become another cautionary tale.

Never lose more than 1% of your account on any single trade. Not 2%. Not "just this once." 1% maximum.

If you're down 2% for the day, stop trading immediately. Come back tomorrow with fresh eyes and capital intact.

Pro Tip from our VIP Discord members: Set your daily loss limit even tighter than your prop firm allows. Most firms give you 5% daily drawdown: use only 2%. This discipline separates professionals from gamblers.

Every trade needs minimum 1:2 risk-reward ratio:

The math is beautiful: Even with 50% win rate, you're profitable long-term. With 60%+ win rate (achievable with proper strategy), you're printing money.

Don't put all your futures contracts in one crypto basket.

The $100K+ traders spread risk across:

✅ Major cryptos (BTC, ETH) – 40% of capital

✅ High-cap alts (SOL, ADA, MATIC) – 30% of capital

✅ Mid-cap opportunities – 20% of capital

✅ Cash reserves – 10% for opportunities

Bitcoin dumps 15%, and suddenly everything bleeds red. Smart traders know this.

They balance:

This diversification across strategies and assets creates consistency while others experience wild swings.

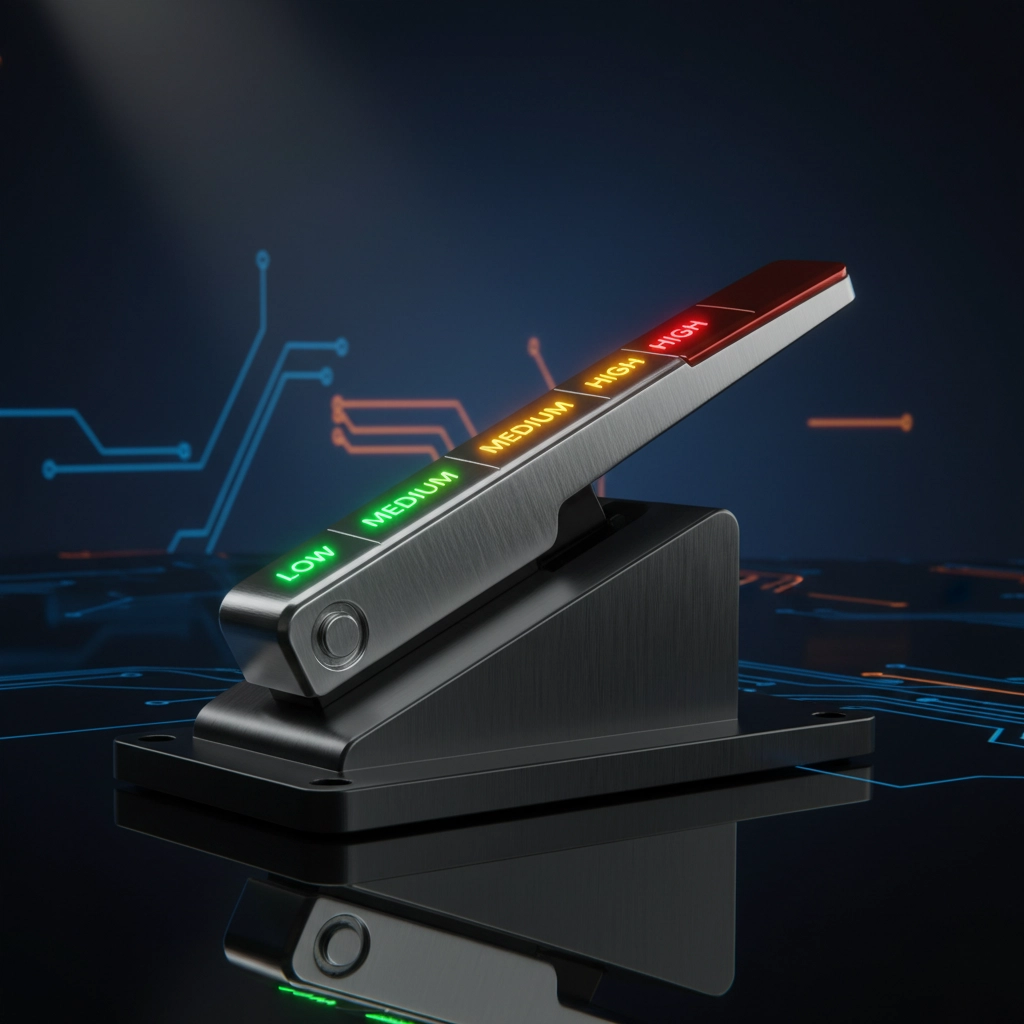

Leverage is the fastest way to $100K… and the fastest way to zero.

Critical Rule: Your leverage should decrease as position size increases. Big positions get low leverage. Small positions can handle higher leverage.

Remember: Liquidation = Game Over. Protect your capital like your trading life depends on it: because it does.

The $100K club doesn't trade by gut feeling. They use systematic monitoring:

Every Sunday, analyze:

This data tells you what's working and what needs adjustment BEFORE small problems become account killers.

Stop gambling with your trading capital. Start building systematic wealth with proven risk management.

The framework works. The question is: Will you implement it consistently or keep hoping for lucky breaks?

The traders making $100K+ started with the same tools available to you today. The only difference? They took action while others kept planning.

The best crypto prop firms are raising their standards and accepting fewer traders. The window for getting funded at current rates won't stay open forever.

Price may increase at any time as our training programs reach capacity.

Don't spend another month wondering "what if." The framework is proven. The community is here to support you.

Your $100K prop account is waiting. 💎

[Take action now →] Visit our complete training system and start building the foundation for consistent, scalable profits in crypto futures trading.

Remember: Risk management isn't the boring part of trading: it's the only part that matters for long-term success.