Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Most crypto traders are flying blind when it comes to market sentiment. 🎯

They're relying on outdated indicators, social media noise, and gut feelings instead of the one data point that actually shows you what's happening behind the scenes: funding rates.

Here's the thing – while retail traders are checking Twitter for the latest "moon" predictions, professional traders are quietly using funding rates to read market psychology like an open book. 📖

Today, you'll learn the exact framework that separates profitable traders from the 90% who lose money.

Funding rates aren't just some boring technical metric buried in your exchange's data feed. They're real-time sentiment indicators backed by actual money.

Unlike surveys or social media sentiment (which can be easily manipulated), funding rates show you exactly how traders are positioning themselves with their wallets on the line.

✅ Real money on the line = Real sentiment data

✅ Updated every 8 hours = Fresh market psychology reads

✅ Available 24/7 = No waiting for market surveys

✅ Cross-exchange data = Comprehensive market view

Think of funding rates as the market's heartbeat – they tell you whether traders are greedy, fearful, or somewhere in between.

Here's how funding rates actually work (and why they're pure gold for reading sentiment):

When funding rates are POSITIVE:

When funding rates are NEGATIVE:

The beauty? This happens automatically based on supply and demand. No manipulation, no fake news – just pure market psychology expressed through financial incentives.

High Positive Funding (0.05%+ every 8 hours)

Moderate Positive Funding (0.01% to 0.05%)

Neutral Funding (-0.01% to 0.01%)

Moderate Negative Funding (-0.05% to -0.01%)

High Negative Funding (-0.05%+ every 8 hours)

This is where the real profits hide:

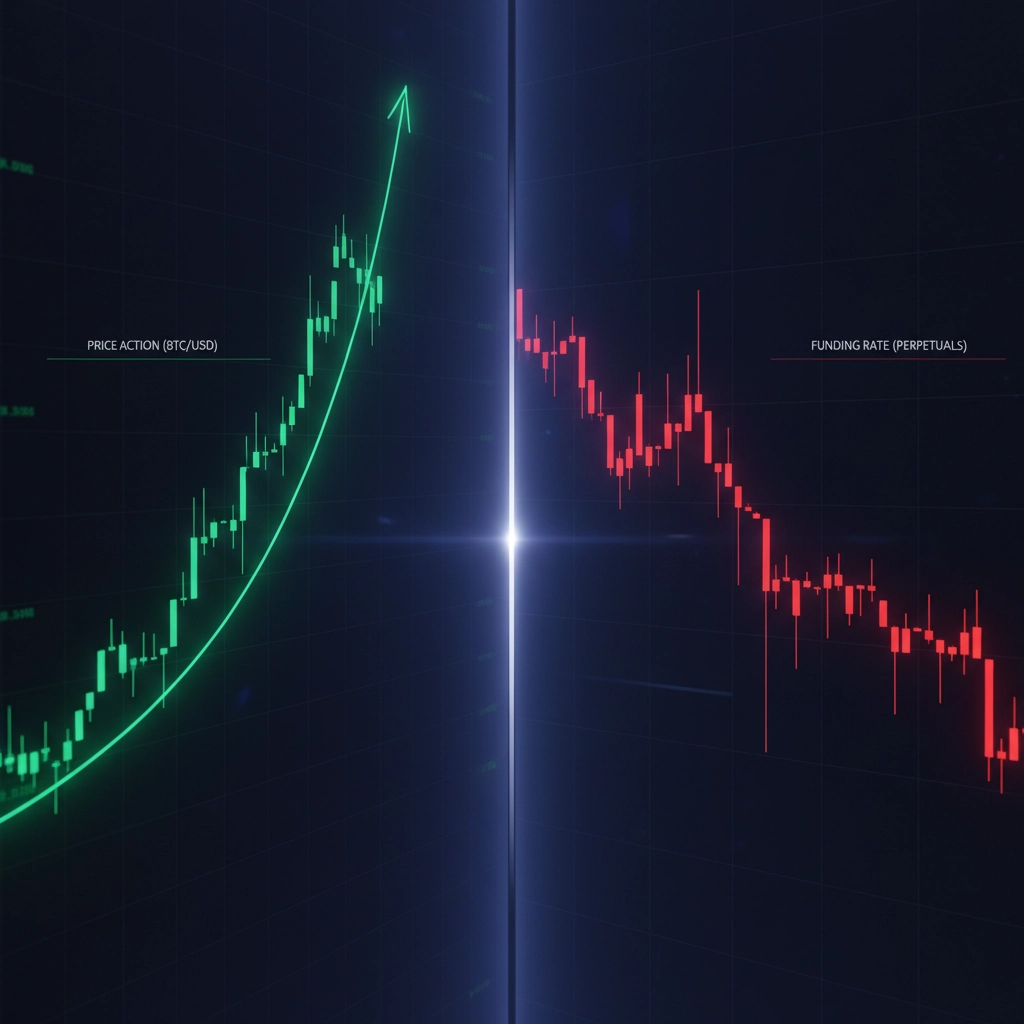

🚨 Price Rising + Funding Rates Falling = Weakening Bull Sentiment

🚨 Price Falling + Funding Rates Rising = Weakening Bear Sentiment

Don't just look at one snapshot – track the 7-day and 30-day funding rate trends:

✅ Consistently rising positive funding = Building bubble conditions

✅ Consistently falling negative funding = Building capitulation

✅ Funding rates returning to neutral = Sentiment reset complete

The million-dollar combination:

When funding rates hit extreme levels (0.1%+ or -0.1%+):

Why this works: Extreme funding rates create forced liquidations, which often mark short-term turning points.

When you spot funding/price divergences:

Don't trade in isolation:

✅ Check BTC funding rates (market leader)

✅ Check ETH funding rates (alt leader)

✅ Check your specific altcoin funding

✅ Look for consensus signals across major pairs

❌ Mistake #1: Trading Every Extreme Reading

❌ Mistake #2: Ignoring the Trend Context

❌ Mistake #3: Using Only One Exchange's Data

❌ Mistake #4: Forgetting About Weekend Effects

Let's break down how funding rates predicted the Bitcoin correction:

March 1-7, 2024:

March 8-15, 2024:

The traders who understood this framework:

Your 5-step action plan:

Remember: Funding rates are a probability tool, not a crystal ball. Use them to improve your odds, not guarantee outcomes.

Ready to master funding rates and dozens of other professional trading techniques?

Join thousands of traders in our exclusive VIP Discord community where we share live funding rate alerts, market analysis, and profitable trade setups daily.

Plus, get instant access to our complete Crypto Futures Mastery Course – the same strategies that helped our students generate consistent profits even in volatile markets.

⚡ Limited spots available – Don't trade alone when you could have an entire community of profitable traders supporting your journey.

The choice is yours: Keep guessing at market sentiment, or start reading it like the pros do.

Your future self will thank you for making the smart choice today. 🎯